If you own and manage your own Veterinary hospital, you’ve probably wondered what you can do to increase your hospital’s value. Understanding your profit and loss statement is the first step in this process and can help you understand where to allocate your attention. If you’re ready to learn how to use the different pieces of the profit and loss statement to better understand your opportunities for improvement and learn our top tips to help improve your operations, continue reading!

What is a P&L?

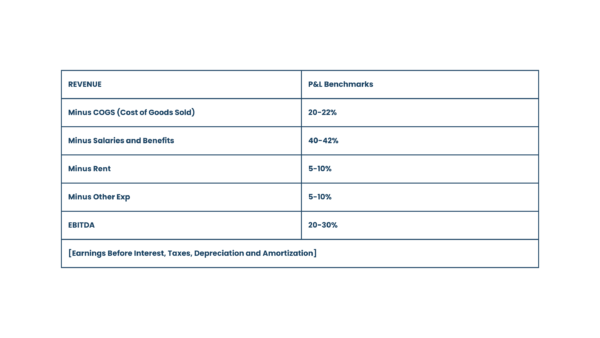

P&L stands for Profit and Loss Statement. This is a financial report showing a business’s revenue, expenses, and net income over a period. At its core, the P&L reflects your revenue minus your expenses. The top line of your P&L is your hospital’s revenue over a given period, all of the earnings from selling your products or services. From there, the next line is your Cost of Goods sold over the same period, which are the costs related to producing the goods or services a business would sell. Labor is the third line; the expense of paying your team and yourself. A well-managed practice, according to us, as well as other resources like AVMA, AAHA, and Veterinary economic research, should benchmark around the following percentages of revenue for each expense category.

The Three Financial Pillars

We believe that there are three main pillars to focus on to have a successful Hospital, these are Revenue Growth, Inventory Management, and Labor Management.

Revenue Growth

Pet hospitals can employ a range of strategies to bolster their revenue, and mostly that boils down to getting more people in the door. The more visits you take, the higher the margins you are able to achieve. Keeping your appointment book full and squeezing in emergency visits or same-day appointments when possible will help you grow your top line. Another thing you can do is make sure your prices are in line with your area, especially if you haven’t changed your prices in years. Years of experience and advanced procedures or services warrant higher prices. Additionally, expanding non-DVM service offerings, capturing all charges on invoices, and calling clients that are overdue are all great ways to boost your overall revenue.

Inventory Management

Your inventory can account for a significant amount of your revenue, up to 20%, sometimes more. Managing inventory can be hard; it requires good control to maintain adequate quantities but not excess, especially when inventory on the shelf is subject to “shrinkage,” or going out of date and, therefore, not being sold. It makes a big difference to have 1-2 employees consistently managing, receiving, and ordering inventory. Additionally, these employees are responsible for making sure that everything runs smoothly, especially regarding high-volume and high-cost items that you are ordering. Some tips to keep your COGS in line are 1) to order for shorter periods of time if possible (monthly vs quarterly) 2) check to make sure your prices are in line with the market & continually adjusted based on cost, and 3) include DVMs in the process to narrow down your carried products.

Labor Management

Labor is the largest and most controllable cost, with its target being 40% of revenue. We recommend that you base labor on the minimum need for DVM hours scheduled. Seasonality should also be considered where, for instance, you might need more staff from April to September than you would during January. Ways to better manage your hospital’s labor are enforcing rules around employees clocking in too early and clocking out for lunch if you are using that system. Another way to manage labor could be using “call-in” shifts to ensure you’re not overstaffed if your calendar is light. Additionally, you may choose to send people home early if business is slow.

Adjustments and Add-Backs

At times, it might make sense to add back certain expenses to EBITDA, especially if you’re using the P&L for a hospital sale. Personal expenses, like family insurance coverage, excess retirement, charitable contributions, life insurance or wages for family members that do not plan on continuing after the sale, can often be added back. Another form of this could be one-time expenses or one-time revenue-altering events, like DVM leave, a broken water main, buying new computers, or any expense that isn’t routine. These types of things are something you should keep track of because these non-repetitive expenses can benefit you and should be added back to your EBITDA to reach an adjusted EBITDA figure.

In conclusion, it’s clear that there’s a range of tools available to enhance your hospital’s value. Whether that is delving into the nuances of Revenue, Inventory, and Labor Management or understanding the intricacies of the Profit and Loss Statement, you’re now equipped to navigate your management endeavors with more confidence than before.

If you’re interested in learning more or would like to start a conversation around your transition goals with our team, please contact us! Whether you are years or months away from a practice sale, our team is happy to answer questions and learn more about your transition goals.